Renters Insurance in and around Abilene

Looking for renters insurance in Abilene?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Abilene Renters!

Home is home even if you are leasing it. And whether it's a townhome or a condo, protection for your personal belongings is a good precaution, even if your landlord doesn’t require it.

Looking for renters insurance in Abilene?

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

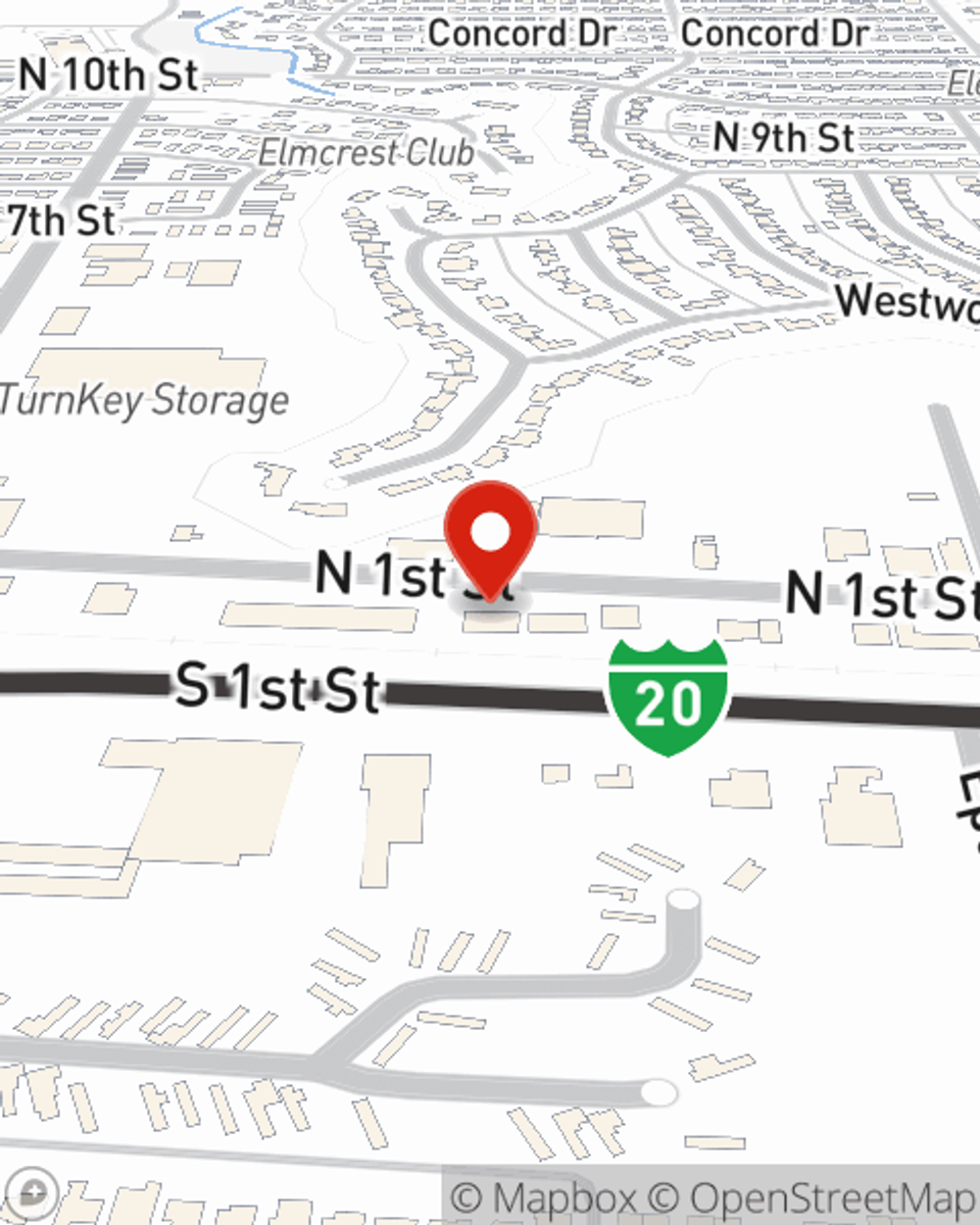

It's likely that your landlord's insurance only covers the structure of the apartment or townhome you're renting. So, if you want to protect your valuables - such as a cooking set, a microwave or a couch - renters insurance is what you're looking for. State Farm agent Neomia Banks has the knowledge needed to help you examine your needs and keep your things safe.

Renters of Abilene, call or email Neomia Banks's office to identify your individual options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Neomia at (325) 672-6491 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Neomia Banks

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.